by Astrid Puentes Riaño

This blog was produced in collaboration with Andrea Rodriguez, AIDA’s lead climate change attorney.

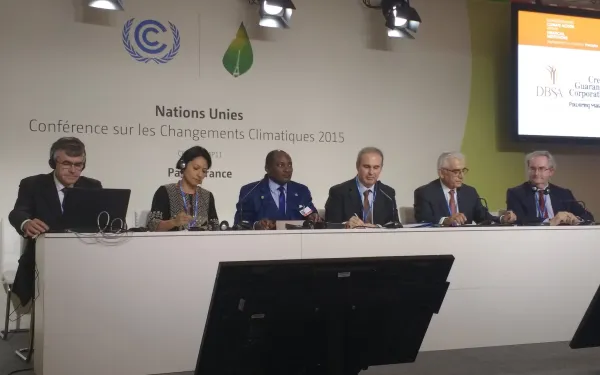

During the Paris climate talks, I had the honor of participating in a panel on climate and the financial sector. We discussed the importance of ensuring that the fight against climate change is consciously integrated into all finance decisions.

Financing is one of the primary challenges that has delayed effective worldwide progress on climate change, because many countries do not have the resources they need, and those that do have the resources haven’t contributed as much as they should. Currently, financial institutions are not providing sufficient funding to combat climate change. In fact, the majority of global resources are still invested in fossil fuels or other activities that have negative impacts on the climate.

AIDA has been advocating at the highest levels to make climate finance more effective for more than five years. Our focus has been on ensuring that the allocation of climate finance is transparent, participatory, respectful of human rights, and responsive to the needs of the Global South. We have advocated for inclusion of and compliance with these principles before international and national financial institutions, as well as in a new global mechanism, the Green Climate Fund.

To advance the discussion, AIDA requested a side event at the climate talks in Paris. As it turns out, a regional financial institution simultaneously requested a side event to present its voluntary principles for integrating climate change into the financial sector. Since there are thousands of requests for side-events and limited space, the Secretariat of the Convention merged the two events.

This is how AIDA came to co-organize an event with a coalition of financial institutions. Although the institutions hadn’t planned to include comments from civil society in their presentation, they agreed to collaborate. This twist of fate created a great opportunity for the institutions to present their principles, and for us to provide early feedback from the point of view of civil society.

Twenty-six institutions have supported the voluntary principles so far, including the Development Bank of Latin America (CAF), the European Investment Bank, the World Bank Group, and the Inter-American Development Bank.

The Five Voluntary Principles, as described by the institutions, are: COMMIT to climate strategies MANAGE climate risks PROMOTE climate smart objectives IMPROVE climate performance ACCOUNT for your climate action

An initial assessment

Is not my intention to make a thorough analysis of the principles at this point. My goal, for the time being, is simply to ensure the principles are known, and to share with you a preliminary analysis, including our initial observations and the five recommendations that I presented at the panel.

As a civil society organization, AIDA welcomes initiatives intended to advance climate action, accountability and participation. We therefore consider the voluntary principles a positive initiative from the financial sector, and a good place from which to start looking for concrete ways to integrate climate change fully into their activities. We consider mainstreaming climate finance an ongoing process, and view these principles as just one element of it.

From AIDA’s perspective, the principles will actually benefit the sector, and help to decrease financial and other risks to financial institutions. If effectively implemented, the principles can help to increase climate actions while protecting communities and ecosystems, and fight poverty and inequality, two of the most important challenges facing the world.

That said, improving access to information is fundamental to ensuring the principles positively impact climate change. Essential information should be made publicly available, including amounts of resources, types of activities or sectors, and projects in which financial institutions are investing.

5 Recommendations for Better Integration

1. Include a human rights perspective and incorporate social risk in assessments

Financial investments that don’t incorporate human rights and social perspectives can contribute to rights violations and have severe impacts on communities. In addition to the consequences such investments have on people, they become a financial risk for the institution.

Incorporating a human rights perspective in risk assessments can also help to advance goals related to fighting poverty and inequality, which are particularly applicable to public financial entities.

2. Define common concepts

Concepts such as sustainable development, climate change, and climate finance can be interpreted very broadly and generate confusion. Additionally, the lack of agreement on what those concepts mean can lead, for example, to one institution considering an activity as clean or sustainable, when it is not.

The definition of renewable energy is a good example. While several major financial institutions agree that large hydropower cannot be considered renewable energy, there are still some institutions that include hydropower, and even nuclear energy, projects in that definition.

The inclusion of experts from the non-financial sector—particularly non-state actors—can help increase understanding of what the needs are and where investment should be enhanced or directed.

3. Create a clear, transparent and participatory road map

The manner in which the voluntary principles are implemented is crucial. Therefore, a clear and measurable implementation plan is essential. It’s a good thing that the financial institutions highlighted the need to avoid duplication, and incorporate lessons learned. However, to ensure that the principles are as effective as possible, it is also important to at least incorporate experiences from existing accountability mechanisms and applications of safeguards.

The current initiative considers a planning group that, as far as we understand, hasn’t been created, although there is a suggestion of how it should be formed. Aligning with the intention of the institutions to include other stakeholders, this planning group should also engage participants outside of the financial sector to increase the impact of investments.

The work plan should include effective mechanisms to measure advancement, and be flexible enough to make necessary improvements. It should be seen as a dynamic process that incorporates lessons learned, not as a rigid mandate.

4. Embrace the opportunity in low-carbon economies

The financial sector has a unique role to play in encouraging climate actions by helping clients avoid the same old carbon-intensive development. Financial institutions have the power to leapfrog this type of development and implement real, effective solutions for the 21st Century. They can be proactive by enhancing the capacity of other actors interested in fully integrating climate strategies into their operations.

The financial sector naturally thrives from risk-taking and innovation. Low-carbon economies represent an important opportunity for growth.

5. Elevate accountability

One question posed during the panel was whether or not the principles should be binding. If there is a strong willingness to implement the principles, and adequate mechanisms to measure advances and make adjustments, having a binding agreement isn’t the most important aspect.

Accountability is key in this process, thus the importance of Principle Five.

Climate change is the most important threat to human kind. It is an urgent matter that most profoundly impacts the world’s most vulnerable populations. There is no more time to lose. Effective actions must continue to be implemented, and the financial sector has an important opportunity to contribute to the solutions, rather than the problem.

It’s time for financial institutions worldwide to walk the talk – it’s time for them to seriously commit to fighting climate change, and to start delivering results.

The opportunity for us as members of civil society to sit beside representatives when they publically presented their five principles was an interesting start. Now we must follow up so that financial institutions put these principles into practice, especially Principle 5: being accountable.

Building upon these comments, and providing recommendations from other stakeholders in the field, will be an important next step.

Read more