Project

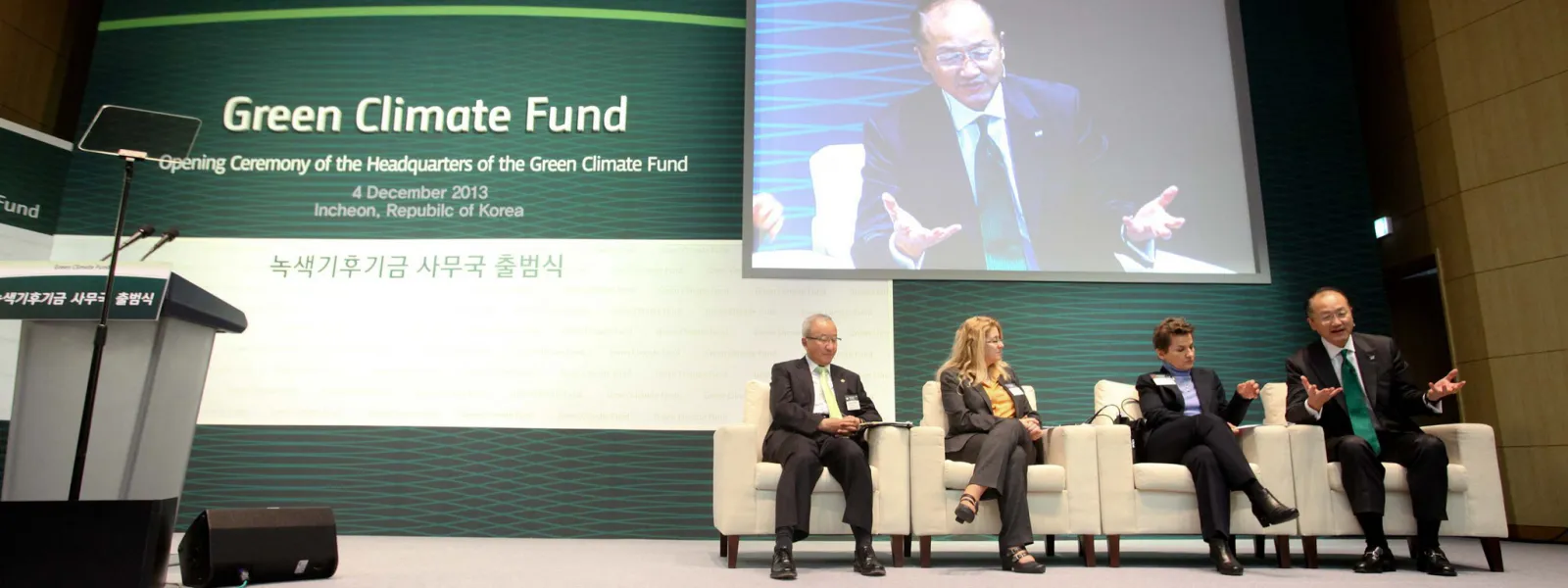

Photo: GCFAdvocating before the Green Climate Fund

The Green Climate Fund is the world's leading multilateral climate finance institution. As such, it has a key role in channelling economic resources from developed to developing nations for projects focused on mitigation and adaptation in the face of the climate crisis.

Created in 2010, within the framework of the United Nations, the fund supports a broad range of projects ranging from renewable energy and low-emissions transportation projects to the relocation of communities affected by rising seas and support to small farmers affected by drought. The assistance it provides is vital so that individuals and communities in Latin America, and other vulnerable regions, can mitigate greenhouse gas emissions and address the increasingly devastating impacts of global warming.

Climate finance provided by the Green Climate Fund is critical to ensure the transformation of current economic and energy systems towards the resilient, low-emission systems that the planet urgently needs. To enable a just transition, it’s critical to follow-up on and monitor its operations, ensuring that the Fund effectively fulfills its role and benefits the people and communities most vulnerable to climate change.

Reports

Read our recent report "Leading participatory monitoring processes through a gender justice lens for Green Climate Fund financed projects" here.

Partners:

Related projects

Latest News

Climate initiatives must not include large hydropower projects – NGOs

In a global manifesto released today, a coalition of more than 300 civil society organizations[i] from 53 countries called on governments and financiers at the Paris climate talks to keep large hydropower projects out of climate initiatives such as the Clean Development Mechanism, the World Bank’s Climate Investment Funds, and green bonds. Large hydropower projects emit massive amounts of methane, make water and energy systems more vulnerable to climate change, and cause severe damage to critical ecosystems and local communities. Including them in climate initiatives crowds out support for true climate solutions such as wind and solar power which have become readily available, can be built more quickly than large dams and have a smaller social and environmental footprint. “Particularly in tropical regions, hydropower reservoirs emit significant amounts of greenhouse gases, comparable to the climate impact of the aviation sector”, said Peter Bosshard, interim Executive Director of International Rivers. “For environmental, social and economic reasons, large hydropower projects are a false solution to climate change.” “Large hydropower projects have serious impacts on local communities and often violate the rights of indigenous peoples to their lands, cultural integrity and free, prior informed consent”, said Joan Carling, Secretary General of the Asia Indigenous Peoples Pact (AIPP). “The resistance of dam-affected communities has often been met with egregious human rights violations.” “Hydropower dams make water and energy systems more vulnerable to climate change,” said Himanshu Thakkar, the founder of the South Asia Network on Dams, Rivers and People (SANDRP). “Dam building has exacerbated flood disasters in fragile mountain areas. At the same time more extreme droughts increase the economic risks of hydropower, and have greatly affected countries that depend on hydropower dams for most of their electricity.” “Wind and solar power have become readily available and financially competitive, and have overtaken large hydropower in the addition of new capacity,” said Astrid Puentes, co-Executive Director of the Interamerican Association for Environmental Defense (AIDA). “The countries of the global South should leapfrog obsolete dam projects and promote energy solutions that are gentle to our climate, our environment and the people that depend on it.” Background Large hydropower projects are often propagated as a “clean and green” source of electricity by international financial institutions, national governments and other actors. They greatly benefit from instruments meant to address climate change, including carbon credits under the Clean Development Mechanism (CDM), credits from the World Bank’s Climate Investment Funds, and special financial terms from export credit agencies and green bonds. The dam industry advocates that large hydropower projects be funded by the Green Climate Fund, and many governments boost them as a response to climate change through national initiatives. For example, at least twelve governments with major hydropower sectors have included an expansion of hydropower generation in their reports on Intended Nationally Determined Contributions (INDCs). Support from climate initiatives is one of the main reasons why more than 3,700 hydropower dams are currently planned and under construction around the world. Further information The civil society manifesto, Ten Reasons Why Climate Initiatives Should Not Include Large Hydropower Projects, is available here. The new video, A Wrong Climate for Damming Rivers, is available at https://youtu.be/UnG_b6egjFk. The following launch events for the manifesto and video will be held in Paris this week: Saturday, December 5th, 12 pm: Press Conference with indigenous leaders and human rights defenders at the International Rights of Nature Tribunal (Maison des Métallos, 94 Rue Jean-Pierre Timbaud, 75011). December 5th, 6 pm - The manifesto and video will be presented at event hosted by the Bianca Jagger Human Rights Foundation (Galerie Thaddaeus Ropac Paris Pantin, Salzburg, 69, Avenue Du Géneral Lecler, 93500, Pantin). Journalists interested in attending should send a request via e-mail by end-of-day December 3rd to: [email protected]. [i] Sponsors: Asia Indigenous Peoples Pact, Asociación Interamericana para la Defensa del Ambiente, Amazon Watch, Bianca Jagger Human Rights Foundation, Carbon Market Watch, France Liberte, International Rivers, Jeunes Volontaires pour l'Environnement International, Oxfam International, REDLAR, Ríos Vivos, Rivers Without Boundaries; South Asia Network on Dams, Rivers and People and Urgewald.

Read moreGreen Climate Fund disappoints by accrediting unfit entities

During its 10th session, in a process characterized by little transparency, the Board of the Green Climate Fund accredited 13 entities to manage financing that the Fund authorizes for climate change adaptation and mitigation projects. The Board accredited the entities as a group, without carefully analyzing them one by one. They did not consider that some have been penalized for financing terrorism and laundering money, or that their primary lending portfolios support fossil fuels. Nor did they consider that some haven’t shown sufficient capacity to manage high-risk climate change projects that could cause irreparable environmental and social impacts. Some do not comply with international fiduciary standards to handle such activities. “We’re disappointed to see that the Green Climate Fund has demonstrated business-orientated behavior, no different from other financial institutions. This doesn’t help the Fund contribute to a paradigm shift and offer better access to resources for local actors,” said Andrea Rodríguez, a senior AIDA lawyer and civil society observer at the Board meetings. The decision-making process for the accreditation of the 13 entities lacked transparency, as no names of the candidates were known until the decision was made. Nevertheless, civil society organizations were able to obtain information to identify inappropriate backgrounds of some of the entities seeking accreditation, and asked the Board to decide on a case-by-case basis. They also requested that the Board assess evidence questioning the ability of these institutions to manage high-risk projects, and to ensure that only the best entities are accredited. The Board, however, opted to make a hasty decision. It reviewed the proposals in a closed Executive Session, and accredited all 13 entities together without considering their problematic histories. “By acting this way, the Board risks the reputation, credibility and legitimacy of the Green Climate Fund,” Rodríguez added. The Board should ensure that all entities seeking accreditation meet the same standards required for access to Fund resources. Developing countries depend on the integrity of accredited entities to ensure access to the financing they need to confront the increasingly severe effects of climate change. It remains vital that the Board guarantees transparency in its decision-making processes.

Read moreGreen Climate Fund Begins Accreditation Process

2015. This is the year. Sink or swim. It’s all or nothing. Opening the Green Climate Fund’s Ninth Meeting of the Board last month, Executive Director Hela Cheikhrouhou spoke with an urgency characteristic of the lead-up to December’s UN Climate Conference in Paris, describing this year as one of the last opportunities humanity has to change course and steer a sustainable path. As we approach the signing of a new global agreement on climate change, the efficacy of the Green Climate Fund (GCF) holds particular importance. Counting now with $10.2 billion, it will serve as the primary vehicle to finance projects designed to help all societies – whether developed or developing – confront the causes, and the effects, of a changing climate. At last month’s meeting, the Fund’s Board accredited its first intermediary and implementing institutions – charged with channeling money into developing nations – and then announced plans to begin allocating its resources before the year’s end. These accreditations, in turn signaling the imminent arrival of the first project proposals, represent an important milestone in the rigorous, nearly five-year process since the Fund was first established. "This will be the ultimate test of the effectiveness of the institution," said Andrea Rodríguez Osuna, AIDA’s Senior Attorney for Climate Change, who has been monitoring the development of the Fund. "When it all comes down to it, this is the step that matters." The first seven entities accredited by the Board represent a broad geographic and thematic range, and will likely be the first to submit proposals for funding. Including organizations from Senegal to Peru, they specialize in issues such as coastal protection, biodiversity conservation, sustainable development, and improving the lives of low-income communities. While the accreditations represent an advance towards the actualization of the Fund’s mission, a number of significant organizational decisions remain under debate, or are as yet unaddressed. Among other topics on the agenda last month, the Board addressed the expected role and impact of the Fund, which will enable them to identify financing priorities, and the Initial Investment Framework, which will outline what types of projects will be financed and how they will be selected and assessed. "Alongside accreditation, these elements are essential. Without them, the Fund can’t advance toward the future, toward having more focused and productive discussions," Rodríguez explained. The criteria and methodology for the Fund’s Initial Investment Framework triggered a heated debate, which largely pitted developed against developing nations. On one side, the developed nations pushed for minimum required benchmarks that would enable simpler measurement of success; on the other side, developing nations pushed for qualitative measures with no strict requirements that would better ensure more equal access to funds. Finally, they reached a compromise, deciding to use non-mandatory indicative minimum benchmarks that would both encourage ambition and take into account the needs of those developing countries most vulnerable to the adverse effects of climate change. The Secretariat will present the proposed benchmarks for further development in about a year’s time, at the 13th meeting of the Board. Discussing the expected role and impact of the Fund, the Board came to an uncharacteristically unified decision – to keep the Initial Investment Framework under review, and to take action as needed regarding the criterion on needs of the recipient countries. Agreeing the document presented by the Secretariat lacked sufficient information, the Board requested they be presented with more technical and scientific data before beginning to outline their priorities. Notably missing from the conversation, due to lack of time, was an item particularly important to AIDA’s work, Enhanced Direct Access, which would obligate public participation in certain projects. If approved, this direct access would ensure the moreequitable involvement of all the actors working to confront the effects of a changing climate. The next meeting of the Board of the Green Climate Fund will be July 6-9 at the Fund’s headquarters in Songdo, South Korea. AIDA will be there again to monitor these issues and report back on important developments, as the world prepares for a new global climate accord, and the Green Climate Fund moves ever closer to implementation.

Read more